This Is Not Financial Advice

A little over a year ago, a trusted friend talked me into doing some personal investing. I downloaded an app that would connect me to the stock market, then began choosing companies and funds to buy tiny pieces of.

Should I have consulted with a professional financial advisor first? Probably. But my curiosity got the best of me.

My first real experience with personal investing was when I bought a house in 2021, during the time when mortgage rates were lower than I may ever see them again. The last four years have made me glad I managed to buy when I did; I appreciate how my home’s value has appreciated.

As I was house hunting, new knowledge of the real estate market made a bunch of question marks pop up in my head. Namely, how can I protect the money I earn from decreasing in value as inflation continues, and how can I help my finances grow long-term along with the economy?

The obvious answer was investing. I invest a piece of every paycheck automatically through my workplace, but that’s retirement savings—I’m not going to see that for another thirty-plus years. So when my friend encouraged me to put some of my savings into the stock market, I went for it.

I was careful. I followed a tip I’d heard on YouTube: “If you’re a beginner, only invest money you’re not afraid to lose.” The market can be a risky place to sock away your money—stocks and bonds bounce around in value daily, their tickers flickering between green and red. So I didn’t chuck my entire savings into the Street; I chose a small amount for starters.

And in the description of that YouTube video I watched was the phrase “This is not financial advice.”

Of course not. Financial (or investment) advice is something people can sue you over. Eek.

And so, I bought some stocks, and I’ve kept a close eye on them. I barely resisted panicking when President Trump’s first tariffs tanked the market, and I started breathing a sigh of relief when the initial shock wore off and they started to rise again.

But now, I’m more curiously concerned about a phenomenon I’m calling the Great Inflate (you heard it here first, folks). You can probably guess what I mean when I say this, though I also mean something deeper than the obvious.

Yes, I’m talking about the rapid rate of inflation the entire world is currently experiencing from spending and losing so much money that no one actually has. We’ve all seen the evidence in grocery store aisles and restaurants.

Yes, I’m talking about the “AI bubble” that many experts are worried is going to pop like an overblown red balloon and take the market down with it.

Yes, I’m talking about how the average housing price is skyrocketing so much that many people wonder if they’ll ever be able to afford their own home.

But deeper than these, I’m also talking about head inflation: there are many people in the world whose wallets and egos are their primary concern, and every day is a payday for them. Their current perceived success is making them dangerously arrogant and antagonistic, unable (or unwilling) to see the plight of the poor and powerless who are currently suffering in their own backyards.

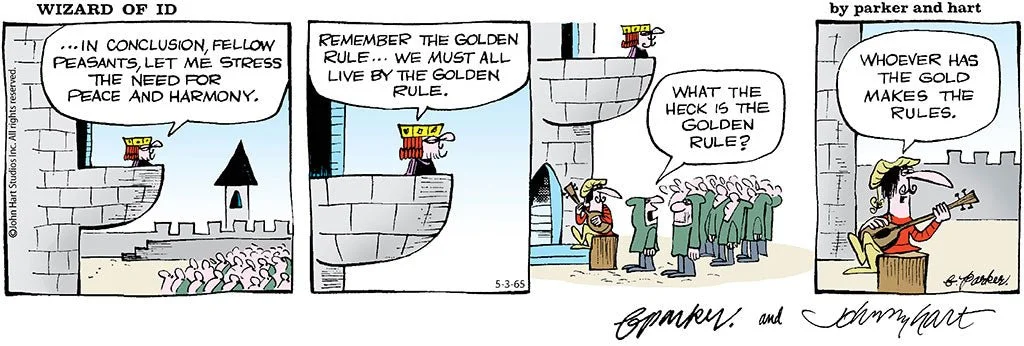

America is considered one of the wealthiest nations in the world. However, a tiny, literally fractional percentage of people in this nation holds a massive chunk of our collective wealth—and our tax laws are quite billionaire-friendly thanks to the billionaires in our government and biggest industries. That tiny percentage of our population then often gets to make the decisions about what gets done with our nation’s wealth and how we interact with other nations in trade.

Yes, I know it sounds cynical. But as the saying goes, “money talks.” And people’s heads keep inflating as dollar signs light up their eyes Looney Tunes-style.

I think many average joes with money woes are just waiting nervously for another 2008-style market crash. Which would probably once again hurt the less-fortunate much more than the hyper-fortunate, because the American economy cannot collapse (not “it actually can’t” but rather “if it does, the world economy will get flushed down the toilet again, and we’ll have bigger problems to worry about than who’s saying what on which podcast”).

I’m considering all of this as I eye my investments and see that some are growing and others are having a hard time holding their heads above water. As I’ve learned in the last year, the up and down is just the way it goes. Both my limited knowledge and naivete will certainly go with me as I finally consult with an actual financial advisor soon, hopefully coming up with a more sustainable simoleon savings scheme.

However, the Lord continues to remind me that a) I won’t take a single nickel with me when I pass into Jesus’ arms one day (I would say “a single penny”, but the Mint stopped making those) and that b) my resources will be best used to help others rather than myself.

I don’t want to be frivolous, though money likes to heat up in my pocket. I want to mix generosity and thriftiness while saving for whatever the future holds.

So if, like me, you’re concerned about the state of our economy and what it will look like in the future, I will say this:

Take a deep breath and focus on what you can do right now rather than what you can’t.

Find a professional who can teach you how to manage the money you currently have. Don’t wait for the “right time” to get your affairs in order.

Find some friends who will encourage you and keep you accountable in your spending and saving. Folks, this is not a time to be shy with your people about your general financial means or lack thereof. We gotta help each other!

And above all, trust not in the fading green in your bank account, or in the red, white, and blue waved by out-of-touch billionaires and pundits who tend to make bank when—or because—others are losing it.

If you’re a follower of Jesus, as I am, trust instead in the black-and-white on the pages of your Bible. The Word commands us to love God above all and with everything, and to love our neighbors—all of them—as ourselves. It also reminds us that our God will never leave or forsake us, and that our true treasure is in Him, not in our bank accounts.

This is not financial advice. It’s an encouragement to steward your resources as wisely as you can, because your future self will thank you.